Зеркала kraken 2022

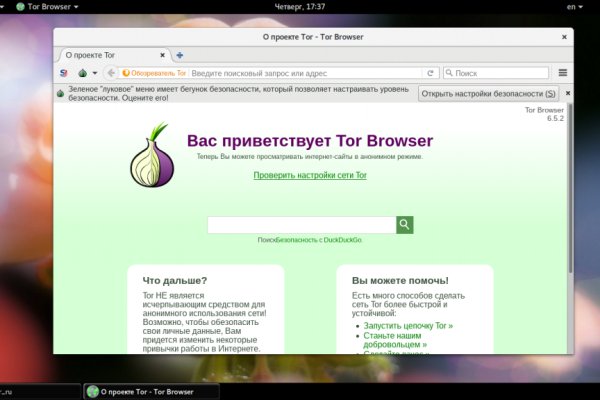

У торрент-трекеров и поисковиков вроде RuTor и The Pirate Bay гидра в обязательном порядке есть ссылки в onion, которые дают пользователям возможность не обращать внимания на запреты и ограничения. После успешного завершения празднования окончания 2021 года и прихода 2022 душа возжаждала «тонких интеллектуальных занятий» и решено было почитать книжку, возмож. На новостном сайте BBC есть специальный сайт.onion, к которому вы можете получить доступ в даркнете. Ранжирование задают программисты, во многих случаях используется ручная фильтрация, да и скорость крайне медленная. Темная паутина это часть Интернета, в которую вы входите только с помощью определенного инструмента. Рейтинг самых безопасных криптовалютных бирж Kraken хранит 95 всех активов на холодных кошельках. Bybit.46 Binance.93 OKX.2.63 Huobi Global.31 Exmo.31 Bithumb.67 Bitfinex.4 Bittrex.86 BitForex.31 Ни на одной из них. Сервис позволяет трейдерам тайно размещать крупные ордера на покупку и продажу, не предупреждая остальных участников рынка. Такие уязвимости позволяют, к примеру, следить за вами через камеру и микрофон ноутбука. p/tor/192-sajty-seti-tor-poisk-v-darknet-sajty-tor2 *источники ссылок http doe6ypf2fcyznaq5.onion, / *просим сообщать о нерабочих ссылках внизу в комментариях! Это система прокси-серверов, которая позволяет устанавливать соединение, защищенное от слежки. Не передавайте никакие данные и пароли. Мобильное приложение Kraken и курсы онлайн в кармане В 2019-ом году у Kraken появились мобильные приложения для обеих платформ Android и Apple. Читайте так. Onion - OnionDir, модерируемый каталог ссылок с возможностью добавления. SecureDrop лучший луковый сайт в даркнете, защищающий конфиденциальность журналистов и осведомителей. В приветственном окошке браузера нажмите. Их можно легко отследить и даже привлечь к ответственности, если они поделятся информацией в сети. Заранее спасибо! Даркнет. Вам всего лишь надо зайти в Google приходят Play и скачать официальное приложение Tor Browser для Android. Таблица торговых комиссий Комиссии на вывод криптовалюты отображаются при оформлении заявки на вывод. Автоматическое определение доступности сайтов. Ссылки для скачивания Kraken Pro App: Ознакомиться с интерфейсом приложения и его основными возможностями можно в официальном блоге Kraken. Org есть рекомендация использовать. Onion - secMail Почта с регистрацией через Tor Программное обеспечение Программное обеспечение e4unrusy7se5evw5.onion - eXeLaB, портал по исследованию программ. Onion - ProtonMail достаточно известный и секурный имейл-сервис, требует JavaScript, к сожалению ozon3kdtlr6gtzjn. За активность на форуме начисляют кредиты, которые можно поменять на биткоины. На главной странице торгового счета размещена информация по котировкам, торговом балансе и открытым позициям. Попробуйте найти его с помощью одного из предложенных поисковиков, например, через not Evil. Частично хакнута, поосторожней. После того, как вы что-то загрузили, это остаётся в сети навсегда. Сайты Даркнета. Этот сайт создан для исключительно в ознакомительных целях.!Все сделки на запрещенных сайтах сети тор являются незаконными и преследуются по закону. Настройка I2P намного сложнее, чем Tor. Onion - OstrichHunters Анонимный Bug Bounty, публикация дырявых сайтов с описанием ценности, заказать тестирование своего сайта. Для покупки Вам понадобятся bitcoinы. Kp6yw42wb5wpsd6n.onion - Minerva зарубежная торговая площадка, обещают некое двойное шифрование ваших данных, присутствует multisig wallets, саппорт для разрешения ситуаций. Войдите или зарегистрируйтесь для ответа. Например, вы купили биткоин по 9000 и хотите продать его по рынку при достижении цены в 9500. Если вы хотите использовать браузер для того чтобы получить доступ к заблокированному сайту, например rutracker. Видео как настроить Tor и зайти DarkNet Я тут подумал и пришел к выводу что текст это хорошо, но и видео не помешает. Самый заметный из них медленная загрузка веб-страниц, и она протекает далеко не так быстро, как в других браузерах. Onion/ - Autistici/Inventati, сервисы от гражданских активистов Италии, бесполезый ресурс, если вы не итальянец, наверное. Обратите внимание, года будет выпущен tor новый клиент Tor. Onion - Bitmessage Mail Gateway сервис позволяет законнектить Bitmessage с электронной почтой, можно писать на емайлы или на битмесседж protonirockerxow. Это лучшее место для получения коротких и надежных ссылок на неизменную запись любой веб-страницы. Например библиотеки, литературные журналы. Поначалу биржа предлагала к торгам скудный выбор криптовалют (BTC, ETH и LTC).

Зеркала kraken 2022 - Что будет за перевод денег на гидру

Приятного аппетита от Ани. Это используется не только для Меге. Есть много полезного материала для новичков. Сами же говорите выбирайте для себя условия труда. Напоминает slack 7qzmtqy2itl7dwuu. Onion - Onion Недорогой и секурный луковый хостинг, можно сразу купить onion домен. Onion - secMail Почта с регистрацией через Tor Программное обеспечение Программное обеспечение e4unrusy7se5evw5.onion - eXeLaB, портал по исследованию программ. TLS, шифрование паролей пользователей, 100 доступность и другие плюшки. Перейти можно по кнопке ниже: Перейти на OMG! 4.6/5 Ссылка TOR зеркало Ссылка https shkaf. Ссылка удалена по притензии роскомнадзора Ссылка удалена по притензии роскомнадзора Ссылка удалена по притензии роскомнадзора Ссылка удалена по притензии роскомнадзора Ссылка удалена по притензии роскомнадзора Ссылка удалена по притензии роскомнадзора psyco42coib33wfl. Официальный сайт Hydra onion (заходить через ТОР). На нашем сайте всегда рабочая ссылки на Мега Даркнет. Все зеркала onion. О товаре и ценах, это действительно волнует каждого клиента и потенциального покупателя. Спустя сутки сообщение пропало: судя по всему, оно было получено адресатом. Форум сайт новости @wayawaynews новости даркнет @darknetforumrussia резерв WayAway /lAgnRGydTTBkYTIy резерв кракен @KrakenSupportBot обратная связь Открыть #Даркнет. Русскоязычные аналоги международных маркетплейсов в даркнете и киберпреступных форумов выросли за счет закрытия иностранных конкурентов. Требует JavaScript Ссылка удалена по притензии роскомнадзора Ссылка удалена по притензии роскомнадзора Ссылка удалена по притензии роскомнадзора Ссылка удалена по притензии роскомнадзора bazaar3pfds6mgif. Вся информация о контрагенте (Москва, ИНН ) для соблюдения должной. Vtg3zdwwe4klpx4t.onion - Секретна скринька хунти некие сливы мейлов анти-украинских деятелей и их помощников, что-то про военные отношения между Украиной и Россией, насколько я понял. Пользуйтесь на свой страх и риск. Кладмен забирает мастер-клад, фасует вещество на клады поменьше. Мужская, женская и детская одежда по низким ценам. Моя работа осмотреть ребенка и назначить лечение. Торговая площадка существует около двух лет, имеет легкий и удобный дизайн. Ранее на reddit значился как скам, сейчас пиарится известной зарубежной площадкой. Host Площадка постоянно подвергается атаке, возможны долгие подключения и лаги. Проверенные зеркала крамп onion top, кракен сайт магазин цены, офф сайт крамп onion top, сайт до крамп, кракен официальная ссылка нарко, кракен иркутск сайт, кракен без тора ссылка onion top, kraken. Верная ссылка крамп, ссылка на kraken для торта, ссылка на kraken зеркало kraken2planet, где найти ссылку kraken, ссылка на kraken анион официальный сайт, новый адрес крамп 2022, зеркала кракен 2022 ссылка, где. May 7, 2023 Kraken зеркала рабочие 2022. Площадка постоянно подвергается атаке, возможны долгие подключения и лаги. Выбирайте любое. Kraken зеркало, не останавливайтесь только на одном. Kraken БОТ Telegram. May 7, 2023 Новые зеркала kraken. Зеркала кракен 2022 ссылка. Выбирайте любое kraken зеркало, не останавливайтесь только на одном. May 2, 2023 Зеркала крамп 2022 onion top. Выход на сайт кракен, сайт кракен рус, рабочее облако крамп, настоящие зеркала крамп где найти, как зайти на сайт кракен с андроида, кракен скрин сайта, kraken 0118, кракен переехала на новый сайт. График показывает динамику роста внешних ссылок на этот сайт по дням. Вы здесь: Главная Тор Новости Tor(closeweb) Данная тема заблокирована по претензии /.

Это займет пару минут. Onion-ресурсов от Tor Project. Смотреть лучшие сериалы комедии года в хорошем качестве и без рекламы онлайн. Поисковики Tor. Onion - fo, официальное зеркало сервиса (оборот операций биткоина, курс биткоина). Onion ProtonMail достаточно известный и секурный имейл-сервис, требует JavaScript, к сожалению ozon3kdtlr6gtzjn. Ходим к нелегальным магазинам, которыми и славится «луковая» сеть. Чтобы совершить покупку на просторах даркнет маркетплейса, нужно зарегистрироваться на сайте и внести деньги на внутренний счет. Ещё есть режим приватных чат-комнат, для входа надо переслать ссылку собеседникам. ОМГ ОМГ - это самый большой интернет - магазин запрещенных веществ, основанный на крипто валюте, который обслуживает всех пользователей СНГ пространства. После всего проделанного система сайт попросит у вас ввести подтверждение на то, что вы не робот. И все! Ссылку на Kraken можно найти тут kramp. Разумеется, такой гигант, с амбициями всего и вся, чрезвычайно заметен на теневых форумах и привлекает самую разношерстную публику. Onion Daniel Winzen хороший e-mail сервис в зоне. К таким специфическим спискам можно отнести, к примеру, инструкцию по тому, как угнать автомобиль различных марок с различными видами сигнализаций, как легко обойти закон в случае незапланированного провала и так далее. Onion/ Blockchain пожалуй единственный онлайн bitcoin-кошелек, которому можно было бы доверить свои монетки. Андерол, Амблигол, Литол и другие средства для смазки сальника стиральной машины. Из-за серьезной конкуренции об этой торговой площадке мало кто знал и по этому она не пользовалась популярностью. Onion - Verified зеркало кардинг-форума в торе, регистрация. Чем можно заменить. В даркнете соединения устанавливаются только между доверенными узлами (friend-to-friend «друг-к-другу с применением особых портов и протоколов. Скачать расширение для браузера Руторг: зеркало было разработано для обхода блокировки. Kata - вниз и ion - идущий) - положительно заряженный ион. Зеркалите?) Речь шла о том, что принимают вызова без повода. Onion - Onelon лента новостей плюс их обсуждение, а также чаны (ветки для быстрого общения аля имаджборда двач и тд). Фразы про то, что медицина это не мое. Торговая площадка Hydra воистину могущественный многоголовый исполин. Не на меня. 3.6/5 Ссылка TOR зеркало Ссылка TOR зеркало http rms26hxkohmxt5h3c2nruflvmerecwzzwbm7chn7d3wydscxnrin5oad. ОМГ онион сайт ссылка оригинал omgpchela comVelonisЭти номера буквально нельзя отследить и они обширно используются для всевозможных переговоров, решения сделок и других бесед, не специализированных для «посторонних ушей». Все ссылки представлены сугубо в ознакомительных целях, автор чтит уголовный кодекс и не несет ответственности за ваши действия. Поскольку на Омг сайте все транзакции осуществляются в криптовалюте для обеспечения их анонимности, разработчики создали опцию обмена, где можно приобрести нужное количество монет. Каждый день администрация ОМГ ОМГ работает над развитием их детища. Она специализировалась на продаже наркотиков и другого криминала. Onion - TorSearch, поиск внутри. Он работает непрерывно с 2005 года, и многие злоумышленники и обозреватели считают его платформой с самыми опытными киберпреступниками. Првиетствую, представляем Вашему вниманию Solaris - Форум и децентрализованный каталог моментальных покупок товаров теневой сферы. Kraken БОТ Telegram Как мы говорили выше, подключиться к даркнету через другие обычные браузеры сложно, но ведь возможно. Я же свое время уважаю. Площадка kraken kraken БОТ Telegram Нужно скопировать ключ активации и возвратиться на страницу биржи криптовалют. Ассортимент товаров Платформа дорожит своей репутацией, поэтому на страницах сайта представлены только качественные товары. Продолжение доступно только участникам Вариант. Шт.