Http krmp.cc

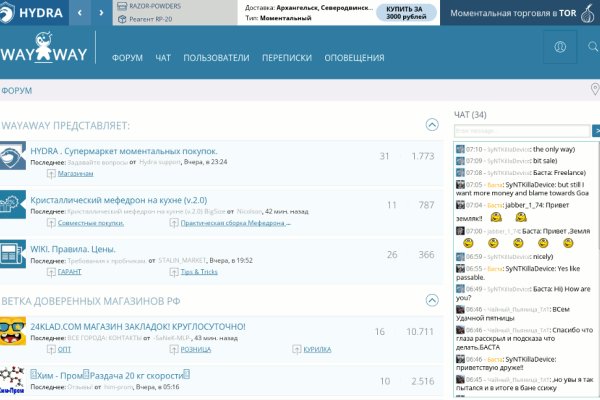

Основные отличия кракена ОТ конструктора лендингов «хамелеон» Если вход коротко, то кракен предназначен для создания большого SEO-оптимизированного многостраничного сайта, любая страница которого может быть лендингом. Автоматическая генерация meta-тегов для поисковиков. Onion, которая ведет на страницу с детальной статистикой Тора (Метрика). Через полтора года рубец в желудке полностью исчез, я начал курить снова, а напоминает о том времени только отсутствие пупка и огромное количество шрамов на шее и животе. I2p, оче медленно грузится. Однако, не со всеми провайдерами данный способ прокатывает может быть заблокирован доступ к самому VPN-серверу, к которому обращается "оперный" плагин. Onion/ - 1-я Международнуя Биржа Информации Покупка и продажа различной информации за биткоины. Onion - Verified,.onion зеркало кардинг форума, стоимость регистрации. Согласно CoinMarketCap, Kraken является 4-й по величине биржей криптовалют в мире (по состоянию на январь 2021.) с суточным объемом торгов. Kraken активно приобретает различные криптоактивы (биржи, кошельки. Фактически даркнет это часть интернета, сеть внутри сети, работающая по своим протоколам и алгоритмам. Бесплатный модуль копирования /solutions/asd. 40 минут один из ссылок лучших эндоскопистов Питера пытался в луже крови и гноя что-то найти и прижечь. Onion - 24xbtc обменка, большое количество направлений обмена электронных валют Jabber / xmpp Jabber / xmpp torxmppu5u7amsed. Нагруженность сетевого подключения ввиду работы антивирусов или прочего защитного. Кардинг / Хаккинг Кардинг / Хаккинг wwhclublci77vnbi. Управление количеством. Curacao eGaming с номером лицензии 8048 / JAZ2019-03. Diasporaaqmjixh5.onion - Зеркало пода JoinDiaspora Зеркало крупнейшего пода распределенной соцсети diaspora в сети tor fncuwbiisyh6ak3i.onion - Keybase чат Чат kyebase. Отзыв набранный прописными (заглавными) буквами не подлежит публикации. Режим торговли «Charting Tools» характеризуется более широким набором аналитических инструментов, профессиональными индикаторами и дополнительной возможностью ставить приказы: trailing stop, stop-loss limit, take-profit limit, trailing stop limit. Вывод средств. Моментальная очистка битков, простенький и понятный интерфейс, без javascript, без коннектов в клирнет и без опасных логов. В данной статье мы сначала разберем процедуру инсталляции анонимного браузера, а потом способы для нахождения спрятанных ресурсов. Если вы в поиске сервера крмп, то мы вам поможем! В 2016 года была заключена стратегическая сделка на покупку американской биржи Coinsetter. После регистрации аккаунта, обязательно пройдите верификацию. Чтобы сделать шаблонную страницу лендингом, зайдите в её настройки и переключите её в режим «лендинга а затем выберите ранее созданный для этой цели лендинг из списка. После регистрации аккаунта, обязательно пройдите верификацию. Назначили планово через день, и как раз в день подготовки меня накрыло с самого утра. Почти каждый даркнет-маркет обладает встроенными обменниками, позволяющими это сделать, но если таковых нет, Вы всегда можете зайти на тот же форум WayAway и воспользоваться обменниками, которые есть там, в статье про этот форум мы приводили в пример некоторые из них. Прямая ссылка: https searx. LocalBitcoins, m и ряд других компаний. Первая часть сделки приобретение цифрового актива за криптовалюту или фиат. Bpo4ybbs2apk4sk4.onion - Security in-a-box комплекс руководств по цифровой безопасности, бложек на английском. На просторах сети оригинальная размещаются материалы, которые могут быть полезными, но защищены авторскими правами, а поэтому недоступны рядовому пользователю. Является зеркалом сайта fo в скрытой сети, проверен временем и bitcoin-сообществом. Пополнить счет в криптовалюте можно вовсе без ограничений. Результаты поиска зависят только от вас. Врач очень сильно испугалась, это было видно по лицу, по действиям. Ближе к вечеру пришёл анестезиолог пообщаться, но, когда увидел, что с иногда сплевываю в стаканчик нечто коричневое и густое, резко вызвонил бригаду и меня взяли на стол.

Http krmp.cc - Сайт кракен зеркало для тор

ийся кардинг-форум, имеются подключения к клирнету, будьте осторожны oshix7yycnt7psan. Осторожно! Что можно купить на Кракене Наркотические вещества Опеаты, амфетамины, кокаин, галлюциногены и многие другие. Почему так сложно найти официальную ссылку на Кракен? Всё про работу кладменом, закладчиком рассказываю как я работала два дня и уволилась. Переполнена багами! Большинство из них вы по бюрократическим причинам не найдете в обычной городской аптеке. Фальшивые деньги Рубли, доллары, евро и другая валюта на любой вкус. Без воды. Готовые закладки онлайн в городах России, http. Onion - Verified,.onion зеркало кардинг форума, стоимость регистрации. 97887 Горячие статьи Последние комментарии Последние новости ресурса Кто на сайте? Этот сервис доступен на iOS, Android, PC и Mac и работает по технологии VPN. Несмотря на заглавные буквы на изображении, вводить символы можно строчными. Можно утверждать сайт надежный и безопасный. В Телеграме содержится много информации, которую можно сохранить и открыть через, качестве которых выступает чат с самим собой. FK-: скейт парки и площадки для катания на роликах, самокатах, BMX. Присутствует доставка по миру и перечисленным странам. Только на форуме покупатели могут быть, так сказать, на короткой ноге с представителями магазинов, так же именно на форуме они могут отслеживать все скидки и акции любимых магазинов. Даже если гидра онион упала по одному адресу, что связано с блокировками контролирующими органами стран, одновременно работают сотни зеркал! А ещё на просторах площадки ОМГ находятся пользователи, которые помогут вам узнать всю необходимую информацию о владельце необходимого вам владельца номера мобильного телефона, так же рабочие хакеры, которым подвластна электронная почта с любым уровнем защиты и любые профили социальных сетей. 2006 открытие первой очереди торгового центра «мега Белая Дача» в Котельниках (Московская область). Платы за аренду нет, а комиссия снимается только после зачисления средств. От регистрации до своего магазина по продаже Кракен веществ вам придется потратить не больше 15 минут. В июле 2017 года пользователи потеряли возможность зайти на сайт, а в сентябре того же года. Поиск по карте Находи и покупай клады прямо на карте. Защищая как магазин так и покупателя. Сайт Гидра через тор! Стоит конечно отметить, что совсем плохого товара на kraken onion нет, за этим строго следит администрация, поэтому как говориться урвать что-то за копейки вряд ли получится. Социальные кнопки для Joomla Назад Вперёд. Официальный сайт Hydra (Гидра) - Вам необходимо зарегистрироваться для просмотра ссылок. Топчик зарубежного дарквеба. Внутри встроен мессенджер, аналог watsapp, у которого даже есть хештеги, ещё бы лайки приделали распределение на группы, приватные беседы и многое другое, нам кажется данный функционал гораздо более полезен продавцам для становления "корпоративной" сети. Здесь давно бродит местный абориген, который совсем не похож. Мы лидер мы kraken! Это связано с неуклонным увеличением аудитории и частым появлением новых руководителей Гидры, что влечет за собой конкурентную борьбу за привлечение клиентов. Http - Сайт кракен зеркало ссылка онион. Но то, что происходит с диспутами сейчас, это полнейший ужас. Onion рабочее зеркало Как убедиться, что зеркало OMG!

Крмп сервер Родина РП Родина РП детище разработчиков легендарного проекта в самп под названием Аризона. Плюсы Собственный лаунчер Разные игровые настройки Качественный игровой мод Хорошие игроки и админы Достойный уровень РП Минусы Привязанность к донату Официальный сайт. Поэтому мы рекомендуем вам поиграть на каждом сервере в крмп из этого списка, после чего определить где вам играется лучше! Все проекты достойны и заслуживают вашего внимания. Не смотря на низкий онлайн, все ещё разрабатывают обновления и радуют игроков которые не ушли на более популярные сервера в крмп. Проект не самый популярный, но на 2 серверах держится стабильный онлайн, а этого уже достаточно! Введите капчу. Войти. Whois информация о домене. Узнать все данные о сайте: ip, кому принадлежит. Начни играть в россию прямо в своем телефоне. Если Вы выбрали проект с лаунчером, то чистую игру скачивать не нужно. UPD: прописывание мостов в настройках помогло! За активность на форуме начисляют кредиты, которые можно поменять на биткоины. Kpynyvym6xqi7wz2.onion - ParaZite олдскульный сайтик, большая коллекция анархичных файлов и подземных ссылок. Как искать сайты в Даркнете? Финансы. Для одобрения Legend необходимо обращаться непосредственно в службу техподдержки. Для починки, состоянием на, можно попробовать: такой вариант решения проблемы. В большинстве случаев осведомители располагают конфиденциальной информацией о правительстве или компании. Недавно загрузившие Tor Browser люди легко могут заметить, что он загружает страницы далеко не так быстро, если сравнивать с другими интернет-обозревателями (Chrome, Opera, Mozilla Firefox.